I am going to post a few links about shorts:

http://www.fool.com/investing/general/2009/04/14/pity-the-short-seller-in-a-market-like-this.aspx (Pity the Short Seller)

http://greenlightadvisor.com/glablog/2009/04/18/stock-performance-based-on-short-interest/ (Stock Performance by Short Interest)

http://online.wsj.com/article/SB124060826688554161.html (Short selling falls)

http://online.wsj.com/article/SB123915041409099017.html (More investors say bye-bye to buy and hold)

http://online.wsj.com/article/SB123981155929121475.html (Great investors who survived the great depression)

http://macro-man.blogspot.com/2008/11/few-thoughts-on-banks.html (thoughts on banks: see charts)

In the exchanges' latest twice-a-month statistics, the number of short-selling positions at the NYSE not yet closed out, known as short interest, fell 2.9% in the period ended April 15. The positions stood at 15,703,379,301 shares from a revised 16,173,689,617 shares in the period ended March 31.

On Nasdaq, short interest fell 4.8% to 6,708,317,025 shares from 7,048,839,387 shares, over the same period.

Investors who short shares borrow and sell them, betting that share prices will fall and that they can buy them back at a lower price for return to the lender. Stocks also can be shorted for reasons other than bearish bets, including hedging strategies.

Marketwide, the short ratio, or the number of days' average volume represented by outstanding short positions, rose to 3.2 days from 3.1 days at the Nasdaq in late March.

The short ratio on the NYSE rose to 2.5 days from a revised 2.3 days during the same period. The Wall Street Journal uses average daily composite volume to calculate the short ratio.

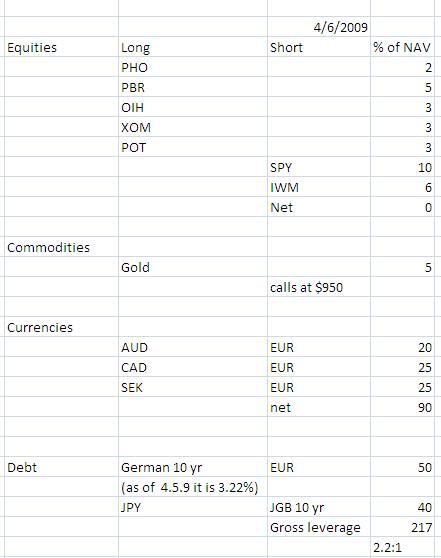

And that graph...

I suppose a nice price to short SPY is at ~ 89.50. Reasoning??

Most people do agree with is a bear market rally, and of course, they are indeed correct. I think a majority of these people think the market has the potential to go up to SPY 95.00 or maybe 100.00. However, with game theory considerations, I would not think it would reach that price if it hits ~90.00 .

First, we should consider the players in the market, and that the market has a zero-sum character to it. (No, I am not interested in academic discussions that the market helps firms raise capital by issuing equity stakes, or futures markets allow producers to hedge...). In other words, one gains the market comes at another person's financial loss, or by others paying an opportunity cost. For example, a producer who wishes to hedges in a futures exchanges pays the opportunity cost of forfeiting the upside of higher prices for the commodity he/she sells. The hedger does not loss any money because he could actually deliver the commodity and cover the liability even if the short position increases in

monetary value. If it is speculator vs. speculator, the speculator selling short losses to the speculator who took the long position if the commodity rises when he buys back the position at the maturity of the contract. In the stock market, one who sells a share of GOOG forfeits potential capital gains (it doesn't pay a dividend) if the price of Google stock rises. The person selling the stock does not lose any money if Google rises as he doesn't have to take on a liability by shorting Google to sell it, but he does pay an opportunity cost if he sells the shares and receives the market price for it.

Now, who are the major players in the market?

Short-term traders (let's assume the WSJ characterizes them in the aforementioned link/ they are novice and should not be confused with speculators who do have information edges, have control of their emotions, and experience.)

Quants

Long-term institutions (hedge funds, wealthy people)

Unsophisticated long-term investors (e.g. people with pension funds, and who watch CNBC)

Let's assume that the prognosticators are correct and that SPY is going to rally to $95.00. The assumption is fairly reasonably, as $95.00 is approximately the 200 day exponential moving average of SPY. If it does hit $89.50, and goes to $95.00, one would have a six percent gain.

I choose $89.50 instead of $90.00 because there is a chance that it would sell-off at $90.00 or when it approaches that number. I would add to the short if it goes to $92.00-93.00.

Quants typically do not go into a large net-long position as they often hedge their positions, and they might turn down their trading volume, which would lower liquidity in this market. Also, since quants are large, they do not have an incentive to go for a potential 6% gain by increasing their net-long position.

Long-term institutions would not be tempted by a 6% gain by being long the stock market. They might try to hedge and outperform by correctly picking stocks since they have superior informed to short-term traders and long term investors. Also, since they have enough capital to hold large positions, holding large positions based on short-term forecasts is not a good idea in a relatively illiquid market. The dividend yield (currently 3.27%) does not compensate for the potential downward volatility.

Regarding the latter, they are too afraid to put their money in the market and a potential 6% gain would not offer a nice risk-reward in the short-term. Furthermore, trading should be difficult by definition, not everyone can could get wealthy in the stock market. Not everyone can follow a forecast that says the bear market could end at SPY 95.00 and sell (or short sell) then because of the zero-sum nature of the market. Whose going to be the idiot that buys when SPY is at $95.00? Essentially, they are receiving the dividend yield of SPY (there could be dividend cuts) and they would be assuming the risk of price change in S&P. Of course, most individuals do not purchase indices, but it is a nice approximation of the net actions of market participants. Again, someone has to loose.

Regarding short-term traders, they do not have an information edge for holding stocks in the long run. They have high discount rates and if there isn't enough momentum (i.e. an influx of cash in stocks), they would liquidate their positions as their positions as they are risky-short term trades. By definition, they do not hold positions for the long run, and a 3% dividend wouldn't be attractive. These short term trades are much like ponzi-schemes; for example, they usually do not buy Citigroup shares because they think companies' equity has any intrinsic value, but because they could sell those shares at a higher prices. Those trades might be vindicated in the long run, but again, they do not have the capability to analyze securities in that fashion. If they are not compensated by high short-term returns, they would just liquidate long positions, and stop-loss orders on positions would lead to a contraction of liquidity and lower prices in a positive feedback fashion. Of course, it is possible that some short-term traders would put in money in the stock market because they are not primarily motivated by financial gain, and trade for other reasons. In other words, they would have an above average risk tolerance, and accept a negative expected value. However, there must be enough of these type of traders to bid it up.

Assuming no other players in the equity market, such as institutions and long term investors, the trading activity of quants and short-term traders is zero-sum. It is a reasonable assumption to presume Ph.Ds who understand partial derivatives and linear algebra would formulate models to defeat the short-term traders (and generate "alpha"), but ironically, they were defeated by the short-term speculators who longed financials and consumer discretionary when the bear market rally became an established trend, and had to cover their corresponding shorts. Of course, most short-term traders are unsophisticated and cannot short. See

this entry from Zero Hedge about the failure (for now) of the quants.

Since short-interest is down, it seems that this would not be fuel for a rally. And besides, if going long doesn't have a good risk/reward profile because if it goes to $95.00, you only make 6% if you buy at $89.50, and you have to deal with the potential for loss such as a retest of the March lows. Conversely, a short position is the enantiomer (a chemistry term, if you do not get it, just replace that with "mirror image") of a long position: if one is short, one risks a 6% loss, but one might be rewarded with a retest of the March lows. Perhaps, the $95.00 for SPY in a bear market rally would be a self-fulfilling view, but game theory considerations argue against it.

My short-term considerations show that short SPY $89.50 has a nice risk-reward. Longer term makes it even better. For example, I'll quote from this

Wall Street Journal article:

All it took was the 100 shares in American Telephone & Telegraph that his grandmother owned to improve his family's experience of the 1930s. Schloss's parents, brother, sister and grandmother all shared a three-bedroom apartment on the Upper West Side of Manhattan, where horse-drawn wagons still delivered milk and the ice truck came by weekly. AT&T's annual dividend of $9 a share went a long way at a time when median rents in that neighborhood were $32 a month. Back then, Schloss says, a dividend was the primary reason "regular" folks invested in the stock market.In other words, stock were not trading vehicles nor did people expect to profit from capital gains. I expect this would repeat.

In other blog entries, I argued that I expect the market to further fall because of high discount rates by market participants in financial markets. These high discount rates are caused by ignorance and incompetence (i.e. an inability to analyze securities to understand their technicals, and their "intrinic value" and cash flows), the empirical falsification that equities do well in the "long run" (let's use ten years), and the inability to take short-term losses (even ignoring my first point about ignorance and incompetence ) due to lack of financial capability (i.e. people afraid of losing their jobs because they would be deprived of cash flow, and they do not have savings or inflated assets to support them). High discount rates should be reflected in lower P/Es and higher dividend yields. Also, a high dividend would protect one from increased downward volatility and decreased liquidity. In addition, one would also receive substantial capital gains when discount rates falls, which is similar to being long duration in bonds when interest rates fall.

Of course, if the position moves against you, the risk/reward profile would look even better, and it would be tempting to add instead of cover. It seems that this rally is about to end, but it would be more disappointing if it ending before it hit $89.50, than if you incur a short term loss if the position rises against you.